Are you paying out of pocket for your ? You shouldn’t be! You have a legal right to free through the Affordable Care Act, which guarantees insurance coverage of “female-controlled” contraceptive methods with no copayment or deductibles. In the years following the passage of the ACA, out of pocket spending on oral contraceptives dropped by a staggering 66.7%.

Having access to no-copay saved people in the U.S. $483 million in 2013, averaging at $269 in savings per person. But in the 12 years since it was passed, the way the ACA is interpreted by insurers and put into practice is murky, to say the least.

Today, many people are seeking out with a new sense of urgency. The overturning of Roe v. Wade and the looming threat that the Supreme Court could revisit Griswold v. Connecticut – a landmark decision protecting the right to access – have changed the landscape of reproductive health care access. Walmart, Amazon and Rite Aid limited purchases of the emergency contraceptive Plan B in recent weeks, after demand soared following the Supreme Court decision. New requests to health care providers have increased too, and more people are seeking out multiple forms of and longer lasting or permanent types of , such as IUDs and tubal ligation.

One in five women are not using their preferred form of , and for 25% of them, it’s because they can’t afford it, according to a 2020 survey by the Kaiser Family Foundation. (Although both the ACA and many research studies use language specific to women in their discussion of contraceptive care, it’s important to clarify that non-binary people and transgender men seek out as well.) That same study found that although two-thirds of privately insured women have covered through their plans, one in five are still paying some out-of-pocket costs for contraceptives.

Having reliable and safe shouldn’t be a costly undertaking, particularly because free contraceptives are guaranteed in federal law. Here, we help you navigate the ins and outs of the Affordable Care Act’s requirements, and how they look in practice.

Who is covered under the ACA?

If you meet the following criteria, then you are eligible for contraceptive coverage through the ACA: you live in the United States, are a citizen or legal resident, are not incarcerated, and have a household income that is between 100% and 400% of the federal poverty level. The 2022 guidelines list the poverty level as $13,590 for a single person household, meaning that an individual who makes up to $54,360 would qualify. Note: the federal poverty level changes every year.

Like what you’re reading? Get the latest straight to your inbox 💌

What does insurance have to cover under the Affordable Care Act?

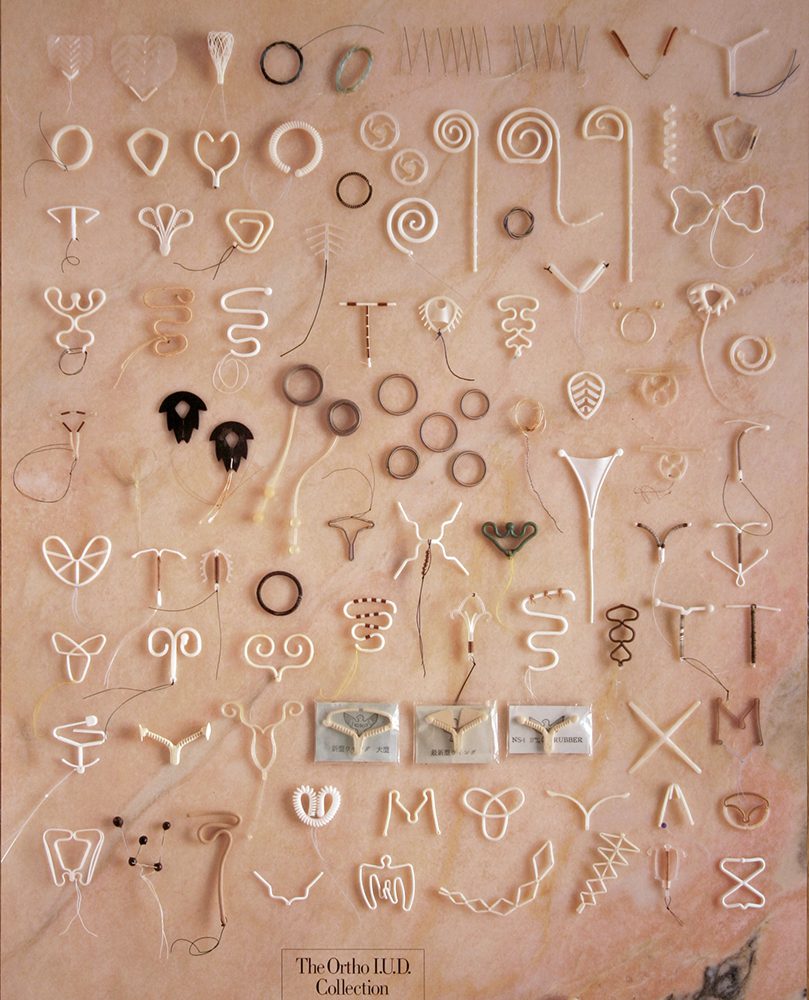

The current guidelines within the ACA require that most private health insurers cover a range of FDA-approved methods that are “female-controlled.” Vasectomies and external condoms are not required to be covered. Related health care services have to be covered as well, along with an annual “well-woman exam,” which includes a pap smear and pelvic exam.

The guidelines explicitly list 18 FDA-approved methods for which insurers have to cover at least one type of contraceptive:

- tubal ligation

- copper IUD

- progestin IUD

- implantable rod

- shot

- oral contraceptive combined pill

- oral contraceptive extended continuous use combined pill

- oral contraceptive mini pill ( only)

- patch

- ring

- diaphragm with spermicide

- sponge with spermicide

- cervical cap with spermicide

- internal condom

- spermicide

- emergency contraceptive

Do all insurers have to comply?

In short, no. A refusal clause in the ACA allows churches, religiously affiliated schools and universities and some charities to refuse to cover contraceptive care for employees. The Trump administration broadened this in 2017, making it easier for employers to not cover if they have any religious or moral objections to covering contraceptives for their employees. This regulation was initially challenged in the courts, but was upheld by the Supreme Court in 2020.

Insurers can also opt out of coverage if it is a grandfathered plan, i.e. one that was purchased before the ACA was passed.

What happens if my physician recommends a type of for me that isn’t covered by my insurance?

When an FDA-approved contraceptive is recommended by a patient’s doctor that doesn’t fall into one of the covered methods, insurers are supposed to have an exceptions process in place so that patients can be covered for whatever contraceptive is medically best for them. This coverage is also supposed to include any associated clinical services the patient may need.

But in practice, many insurers are not following this rule. A 2022 study by Power to Decide found that few insurance plans have an exceptions process in place that meets the standards set out in the ACA. Insurers are also failing to cover more newly approved forms of . The National Women’s Law Center has fielded thousands of calls on their hotline CoverHer, with reports of problems getting covered as it’s supposed to be under the ACA.

It's simple: it's the law for insurance companies to cover the cost of . That's not always the case—and I'm working to fix it. https://t.co/wlgblRVG3X

— Senator Patty Murray (@PattyMurray) February 15, 2022

Following the Supreme Court’s decision to overturn Roe v. Wade, the Biden administration has been putting increased pressure on insurers to follow the guidelines for contraceptive coverage in the ACA. A joint letter sent to health plan issuers by the secretaries of health and human services, labor, and the treasury highlighted the problems of noncompliance with the ACA’s guidelines among insurers and threatened to take corrective actions in the future.

What should I do if my insurance won’t cover my ?

Although you can file a complaint if you are denied coverage in violation of the ACA, for a lot of us, going to battle with your insurance company is a time consuming headache that might not be successful or worth it in the end. And although lawmakers are increasing calls for improvement in enforcement of the ACA’s contraceptive rules, whether they will actually be implemented is uncertain at best.

The path of least resistance, and a good first step, is to see if there is another insurance provider you can switch to on the marketplace that does cover your preferred type of . Additionally, you can consult with your physician or OB-GYN about the options that are covered under your insurance to see whether there’s an appropriate alternative option for you. Finally, calling the CoverHer hotline can help with advice and personalized recommendations for navigating conflict with your insurer or seeking out alternate options for coverage.